Fi tmiem il-ġimgħa li għaddiet attendejt konferenza internazzjonali ta’ livell għoli f’Doha, il-belt kapitali tal-Qatar, li kellha l-għan li jkompli jkun miġġieled il-faqar dinji permezz ta’ finazjament aħjar għal proġetti ta’ żvilupp. Konferenza organizzata mill-Ġnus Magħquda flimkien mal-Qatar bit-tema “Financing for development and the means of implementation of the 2030 agenda for sustainable development”.

![]()

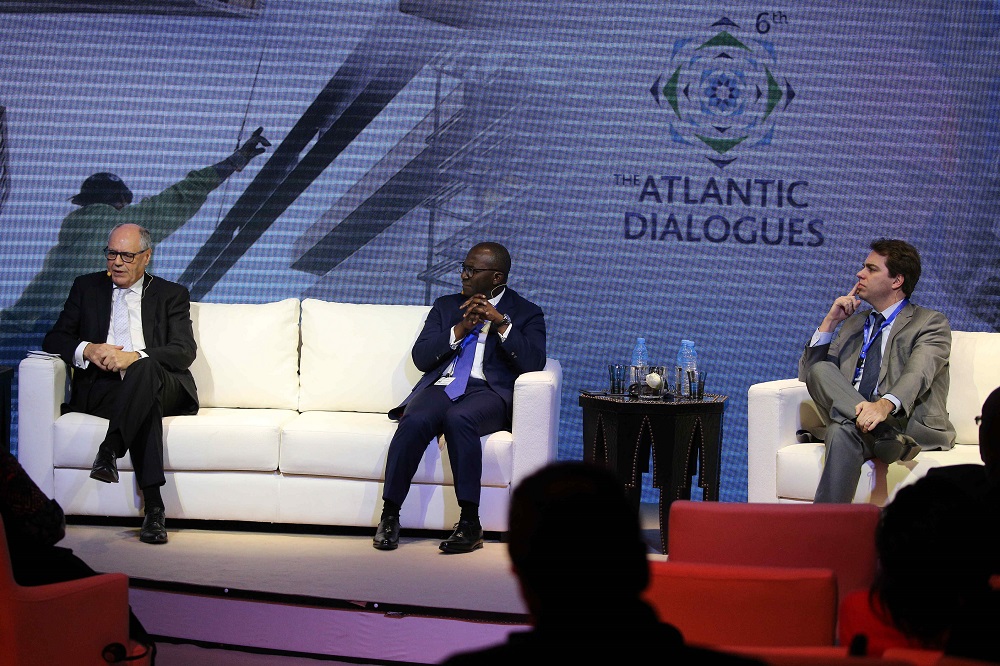

Flimkien mal-Ministru għall-Finanzi tal-Qatar Ali Shareef Al Emadi (it-tielet mix-xellug) deħlin għall-konferenza ta’ tmiem il-ġimgħa li għaddiet f’Doha, belt kapitali tal-Qatar.

It-terminu FAQAR huwa wieħed kumplikat immens. Terminu li jista’ jkun interpretat b’diversi modi. Għandek dak li jissejjaħ faqar relattiv u għandek il-faqar assolut. Il-faqar mhux bilfors ikun ifisser biss nuqqas ta’ finanzi. U huwa għalhekk li l-faqar jitqies bħala xi ħaġa kumplikata, speċjalment f’kuntest globali, li tagħmel x’tagħmel, b’xi mod, f’livell jew ieħor, qisu se jibqa’ miegħek.

Huwa minnu li l-finanzjament huwa importanti fil-ġlieda kontra l-faqar permezz tal-iżvilupp, imma mbagħad hemm il-kriterji ta’ kif jintużaw dawn il-finanzi fil-ġlieda kontra l-faqar. Il-flus jistgħu jkunu l-assolut f’kampanja speċifika, bħal per eżempju biex ikun provdut ikel jew ilbies, għal numru ta’ nies li jkunu tilfu kollox f’diżastru naturali li jkun laqat lill-post fejn ikunu qegħdin jgħixu. F’każ bħal dan, tali provvisti jkunu l-ħtiġijiet immedjati.

Fuq xenarju globali fejn żewġ terzi tal-popolazzjoni tad-dinja għadhom f’xi forma ta’ faqar, il-faqar ma jkunx kawżat għal għarrieda. Ikun allura irid jiġi studjat x’ikun qed jikkawża dik is-sitwazzjoni, li ma tkunx waħda temporanja. Raġunijiet kumplikati riflessi f’nuqqas ta’ xogħol fil-pajjiż konċernat, problemi soċjali, nuqqas ta’ edukazzjoni, livell baxx sanitarju u ta’ saħħa u istituzzjonijiet dgħajfin.

Il-livell tal-faqar dinji jvarja minn faqar kbir ta’ ġuħ għal faqar kawżat minn sotto żvilupp, fejn minkejja li għandek dħul mhux ħażin xorta jibqgħu jippersistu s-sintomi ta’ faqar u ta’ nuqqas ta’ żvilupp. Għalhekk tkun meħtieġa t-tfittxija għar-raġunijiet għala żvilupp li jkun għaddej minnu pajjiż ma jkunx għaddej bih pajjiż ieħor. Xiħaġa li sfortunatament ma tikkonċernax biss reġjuni partikolari, jew pajjiż partikolari, imma kontinenti sħaħ bħalma huwa l-kontinent Afrikan, fejn il-maġġoranza assoluta tal-pajjiżi li jiffurmaw dan il-kontinent għadhom ferm bogħod milli jilħqu dawn il-miri.

L-għaqda dinjija tal-pajjiżi, il-Ġnus Magħquda, hija konxja minn din is-sitwazzjoni. Il-membri li jiffurmawha kollha jafu li jrid isir xiħaġa f’dan ir-rigward. Minn dejjem ġew iffissati miri fil-konfront tal-ġlieda dinjija kontra l-faqar.

Fis-Sena 2000, il-bidu ta’ millenju ġdid, kienu tfasslu dawk li ssejħu Millennium Development Goals, il-miri ta’ żvilupp. Dakinhar id-dinja riedet, u fasslet, kemm jista’ jitnaqqas il-faqar dinji fi żmien 15-il sena. Dak it-terminu għalaq fis-sena 2015 imma l-faqar għadu magħna.

Għandna allura naqtgħu qalbna jew għandha tonqsilna r-rieda milli nkomplu bil-ġlieda tagħna kontra l-faqar? Żgur li le. Huwa għalhekk li nħolqu miri ġodda, miri maħsubin biex ikunu intlaħqu sas-sena 2030, Development Agenda 2030, l-aġenda ta’ żvilupp.

Development Agenda 2030 tinkludi 17-il mira. Qabel kienu tmienja u issa saru 17. Saru 17 għax tmienja kienu miri dojoq wisq. Issa huma aktar miftuħin u jipprovaw jolqtu kull aspett tal-iżvilupp. Hemm diversi eżempji ta’ dawn l-aspetti, bħalma huwa t-tkabbir ekonomiku li kważi huwa xi ħaġa bażika. Hemm il-qasam tas-saħħa, il-qasam edukattiv u hemm il-qasam tal-ambjent. Kull qasam huwa mira fih innifsu.

Aspetti li għalkemm ikunu ‘komuni’ ma jkunux ifissru l-istess għal kulħadd. Nagħti eżempju. Kull pajjiż jista’ jkollu l-ilma, imma mhux kull pajjiż għandu ilma nadif. Ilma mhux nadif jikkawża l-mard u l-imwiet.

Għandek l-ibliet. Kull pajjiż għandu l-ibliet tiegħu imma mhux għal kull pajjiż ifissru l-istess. F’pajjiżi sotto żviluppati l-ibliet huma mifnijin mill-problemi għas-sempliċi raġuni li l-maġġoranza tal-popolazzjoni timxi lejhom għax hemmhekk biss hemm il-faċilitajiet edukattivi jew tas-saħħa, hemmhekk biss hemm l-umanità fl-iżvilupp tagħha. Sitwazzjoni li mbagħad twassal għal problemi kbar sanitarji kawżati minn nuqqas ta’ provvista adekwata ta’ ilma, servizzi ta’ drenaġġ, nuqqqas ta’ postijiet ta’ abitazzjoni. Eżempju klassiku huwa l-Kajr, fl-Eġittu, fejn wieħed mill-ikbar ċimiterji huwa miżgħud bin-nies għax m’għandhomx fejn joqogħdu. Inkella għandek postijiet fejn in-nies jokkupaw anke l-bjut.

Development Agenda 30 għandha miri oħrajn, apparti l-faqar. Hemm il-ħajja fuq l-art, il-ħajja ta’ taħt il-baħar, il-kwistjoni tal-ugwaljanza, l-ugwaljanza tal-ġeneru, ir-rwol tan-nisa f’dak li huwa żvilupp. Dan kollu qiegħed ikun segwit globalment u għalhekk isiru konferenzi bħal dik li rreferejt għaliha fl-introduzzjoni ta’ din il-kitba. Jattendu għalihom il-Ministri tal-Finanzi għax ovvjament inutli jissemmew u jitfasslu proġetti jekk ma jkunx hemm finanzjament għalihom.

Apparti li bħala poplu Malti huwa fatt magħruf kemm inkunu ġenerużi kull meta jinqala’ l-bżonn mhux biss lokalment imma anke internazzjonalment, bħala pajjiż nagħtu s-sehem tagħna wkoll. Huwa dmir morali li nagħtu rendikont ta’ kemm nagħtu flus għal dan l-iżvilupp. Nagħżlu aħna lil min nagħtu, u kif nagħtuhom. Għandna proġetti fl-Afrika u fl-Asja u ‘l quddiem ikollna wkoll fl-Amerika t’Isfel.

Il-flus huma importanti biex isiru l-proġetti, imma l-iżvilupp mill-faqar jibqa’ jkun kumplikat. Dan m’għandux jaqtgħalna qalbna. Nafu kemm kien hemm pajjiżi li kienu fil-faqar u żviluppaw u llum jinsabu ferm aħjar. Dan għandu jagħmel kuraġġ lil pajjiżi oħrajn li llum jinsabu f’diffikultajiet, li għadhom lura filwaqt li nittamaw li fl-għaxar, ħmistax-il sena li ġejjin naraw aktar pajjiżi joħorġu mill-faqar u jkunu parti mid-dinja ċivilizzata u industrijalizzata għal ħajja aħjar flimkien.

![]()

Il-Ġimgħa 24 ta’ Novembru 2017